Turn Market Gains into Community Good

While the market is up, giving of appreciated stocks and mutual funds makes good sense.

Giving now while the market is up makes it possible to take an income tax deduction for the full fair market value of shares — and avoid long-term capital gains tax on the appreciation.

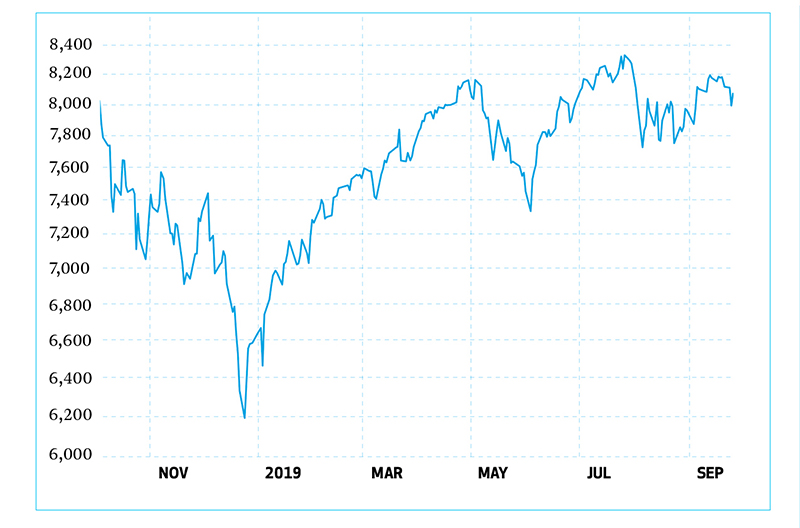

The stock market is approaching record heights, but a glance back at the NASDAQ for December 2018 suggests that the market bubble may be about to burst. That poses both a challenge and an opportunity for charitably minded investors who would typically give at year-end. If donors wait too long and the market dips, then potential tax deductions and the amount available to give to charity goes down.

Giving now, while the markets are still high, neutralizes this volatility. Donations of appreciated stock or mutual fund shares (held for more than a year) provide greater tax advantages than gifts of cash. The only difference is that donors are making the gifts they would normally make a few weeks earlier than planned.

Why experts predict a market drop: The so-called “Buffett Indicator” is the ratio of the total U.S. stock market valuation to the gross domestic product (GDP) and named for master investor Warren Buffett. A measure of 100% indicates that stocks are valued fairly, while higher levels suggest that stocks may be overvalued. In 2000, at the height of the dot-com boom, the indicator set a record of 148%. On Sept. 20, 2019, the indicator had reached 144%, signaling that market declines may be about to occur.

According to Pittsburgh Foundation Executive Vice President Yvonne Maher, “The Buffett piece is very telling. It only takes looking back to December of last year, when the market dipped dramatically, to see that people didn’t get enough bang for their year-end charitable buck.”

The Community Foundation of Westmoreland County is an affiliate of The Pittsburgh Foundation.

Donors who wait to give may miss the opportunity for appreciation.

“Why not just bake in the market gains today by donating appreciated securities now? If the stock market declines as we saw in December 2018, you will secure the fair market value as a charitable deduction. If you think the market still has some growth and you like the stock, donors could buy that same stock back through cash and step up the basis,” Maher says.

The strategy makes good sense for investors who are charitably inclined and for their advisors.

“Referring clients now to the Foundation to donate appreciated stocks and mutual funds while the market is up is a triple win,” says Peter M. Strope, CAP®, CFP®, managing director of Strope Financial Group at UBS. “My clients achieve their charitable goals. They minimize the risk of potential market volatility while maximizing tax efficiencies, and they benefit charities in need.”

The “give early” strategy also has benefits in capital gains. If a stock has increased in value since the time it was purchased, then the stock holder pays capital gains on the increased value. But if the stock’s value declines, then donors can deduct the full market value and lock in those charitable deductions for five years.

Greg Allison, CPA, JD, CFP ®, who is a shareholder at Schneider Downs & Co. explains.

“If you bought a stock for $10 that is now worth $30 and you donate the stock now, you get a charitable deduction of $30, subject to certain income limitations. But if you wait until the end of the year, and the stock’s value goes down to $20, then your deduction would be based on that lower value,” says Allison.

Allison also points out that, if you donate a stock, but still like it as an investment, you can buy it again to reset your basis at a higher value. If the stock appreciates again, this will reduce your future capital gains tax when the investment is ultimately sold. If the stock happens to decrease in value, it may present tax leveraging opportunities. For example, if you buy it at $30 and the stock’s value declines to $20, Allison says, “you could harvest the loss by selling the stock for $20 and then use the $10 capital loss to offset other gains.”

The Foundation has also been seeing donors giving year-round instead of waiting until year-end.

“People are being opportunistic in taking the appreciation because they are concerned about seeing how far south the market’s value went last December,” Maher says.

More Bank for your “Bunch.” This trend toward year-round giving may be due to the 2018 Tax Cuts and Jobs Act, which increased the standard deduction. According to the IRS, the act nearly doubled the standardized deduction to $12,000 for individuals, $18,000 for heads of household and $24,000 for married couples filing a joint tax return. These changes mean that, for most people, itemizing every year is no longer worthwhile. Many savvy taxpayers are now “bunching” their giving, meaning they compile their donations into one large gift that exceeds the standard minimum deduction.

While not all charities are set up to accept gifts of stock and other securities, community foundations such as The Pittsburgh Foundation can. Donors who set up donor-advised funds at a community foundation then make gifts from their funds to nonprofits they would normally support. This approach allows donors to exceed the standard deduction, to itemize in future years and to benefit from the expertise of the Foundation for grant-making consultation.

The power of community foundation donor-advised funds: The number of donor-advised funds (DAFs) at The Pittsburgh Foundation and the assets in those funds have grown significantly over time, creating significant benefits for the community: From 2009 to 2018, grants to nonprofits from DAFs doubled from 588 donor-advised funds representing $133 million to 1,070 donor-advised funds representing $338 million in assets. Likewise, in 2009, grants to the Pittsburgh community totaled $11 million. By 2018, the Foundation’s annual grantmaking had doubled to $22 million. This comes as no surprise to Foundation staff.

“I have never experienced a community of givers like Pittsburgh and western Pennsylvania. Local people who make their money here give back here,” Maher says.

The Foundation also sees donors using required minimum distributions from their IRAs to establish charitable funds.

“If you’re 70 ½ or older, you can give up to $100,000 annually to set up a scholarship fund at The Community Foundation of Westmoreland County or The Pittsburgh Foundation or establish a designated fund to benefit a specific charity, or an unrestricted fund that our Foundation can use to support the most pressing community needs,” says Maher.

2019 END-OF-YEAR GIVING DATES

- Last day to contribute a mutual fund to TPF/CFWC (in most cases): Dec. 13.

- The opportunity to recommend a grant by paper or email for end-of-year payment closes at 12 p.m., Dec. 20.

- The opportunity to recommend a grant through the online portal for end-of-year payment closes at 12 p.m., Dec. 27.

- The last day a stock gift can be deposited in the TPF/CFWC account: Dec. 31.*

- Checks must be postmarked by year-end: Dec. 31.

- Our offices are closed on Nov. 28, Nov. 29, Dec. 24, and Dec. 25.

- Our offices are open until 3 p.m. on Dec. 23 and Dec. 31.

*Please make the Foundation aware of your stock gift ahead of the transfer.